Money and Pensions Service publishes new report by DJS Research exploring children and young people’s financial education

14th October 2025 13:42

.jpg)

Over the course of the last year, DJS Research has been collaborating with the Money and Pensions Service to explore the experiences of children living in low-income households in relation to their financial education. Director and children & young people research lead Helen Menzies shares her reflections on the project now that the research has been published.

News article by Helen Menzies, Director & Children & Young People Research Lead

Back in November 2024, we were delighted to be chosen to work with the Money and Pensions Service (MaPS) to conduct an important piece of research on the topic of children’s financial education. As a children and young people (CYP) specialist with a background in Financial Services research, this project felt like the perfect fit for me.

The initial brief

Previous research conducted by MaPS had shown that CYP in low-income households are significantly less likely to have the foundations of good financial wellbeing compared to their peers in high-income households. Further research was now required to better understand the experiences of children (and their parents) from low-income households, the barriers they face and ultimately help to identify opportunities for financial education interventions.

What did we do?

It was clear from the outset that in-depth qualitative research was needed. In order to understand the experiences of the young people and their parents, we felt it was really important to meet them in person, so we developed a methodology that included:

- 58 x in-depth interviews with 11–18 year olds and their parents (over 50 of these were conducted in home) around the UK. We spoke to the CYP and parents online first and asked them to complete a short pre-task ahead of their main interview, which lasted up to 2 hours.

- Interviews and workshops with 40 practitioners working closely with vulnerable children, including social workers, family support workers, therapists and youth leaders.

- 20 x follow-up telephone interviews with a selection of parents.

The study explored how children and young people currently learn about money, their aspirations, the influence of parents/carers, and the capacity of practitioners to support financial education.

Travelling around the UK meeting these families was a truly eye-opening and rewarding experience, which enabled us to put their experiences, needs and barriers in the spotlight. Added to this, our interviews with practitioners allowed us to learn about CYP experiencing more extreme circumstances including those living in temporary accommodation, foster care, high levels of deprivation and some either not regularly attending, or excluded from, school.

Engaging outputs

With the help of our in-house Creative Services team, we were able to summarise months of fieldwork and analysis into a 3-minute video, which you can watch here: Children and Young People living in low-income housholds and their financial education video summary.

Our research revealed an appetite amongst 11-18 year olds from low-income households to learn about money. Similarly, their parents consistently expressed a strong belief in the value of financial education for their children, particularly in light of their own financial vulnerability. Parents identified a need for additional support to help them feel more confident delivering financial education to their children at relevant points in their lives, starting from a young age.

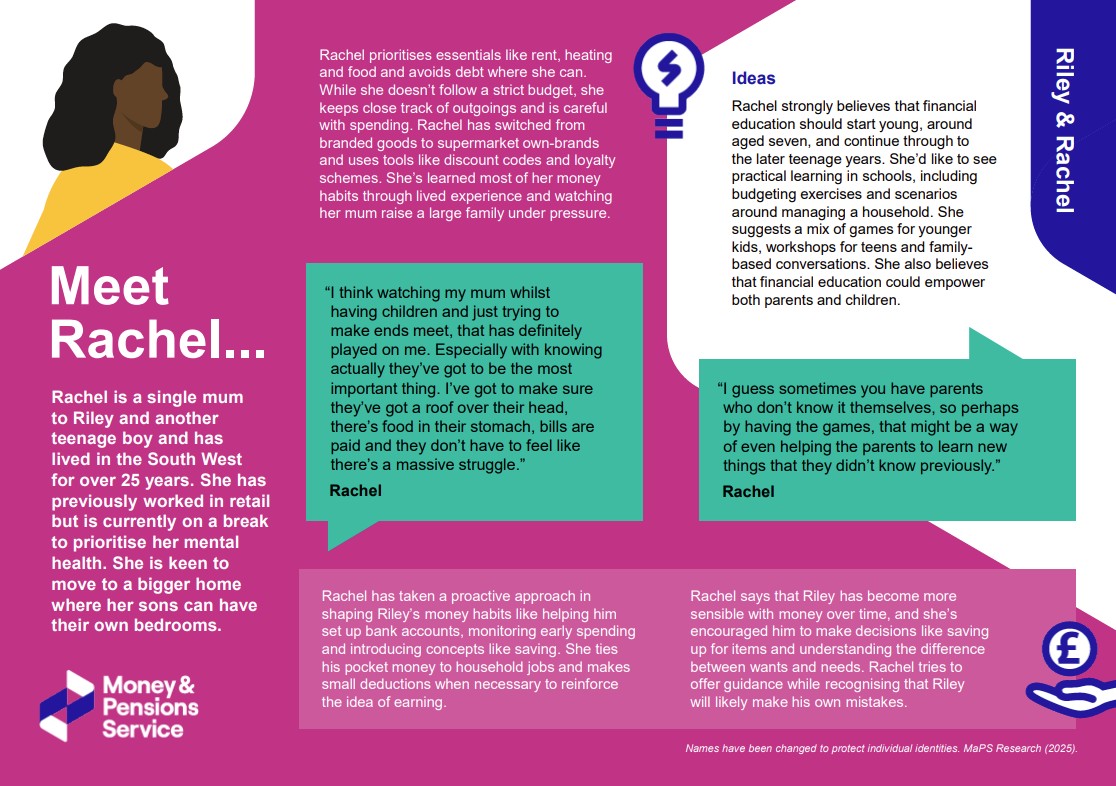

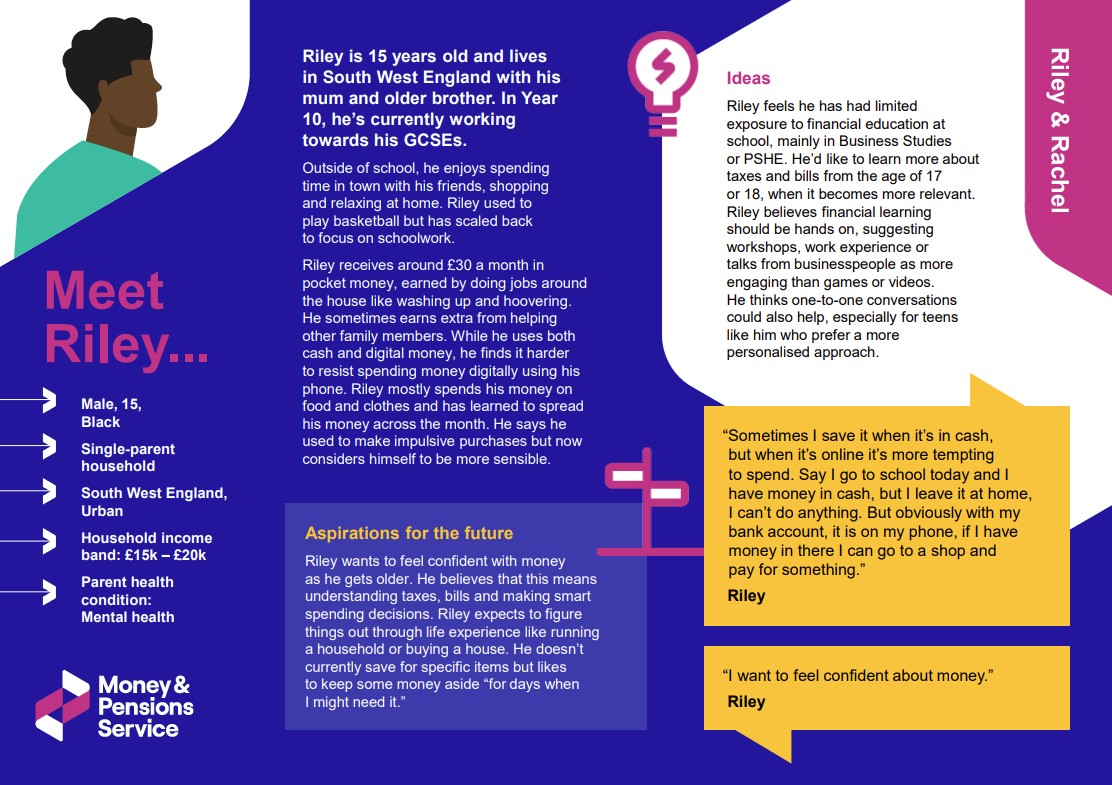

In addition to a PowerPoint debrief and detailed Word report, we also produced a series of case studies to bring the stories of the CYP and their parents to life. As you can see in the example below, each case study described the aspirations and ideas for the future from both the CYP and parent point of view.

You can download the full report here.

What next?

The study forms part of MaPS’ work to support progress towards their goal of two million more CYP receiving a meaningful financial education by 2030, set out in the UK Strategy for Financial Wellbeing. MaPS plan to use the findings to support key stakeholders to develop relevant and quality financial education provision for CYP in low-income households and their families, ultimately helping to reduce the financial capability gap.

If you would like to find out more or you have a similar project in mind please get in touch with Helen Menzies at hmenzies@djsresearch.com.