Mixed consumer confidence for the year ahead as Brexit looms

7th March 2019 10:30

.jpg)

Written by Gill Redfern, Research Director. Contact Gill here

As the UK anticipates the outcome of Brexit and the political and economic aftermath which will follow, consumers are waiting with bated breath to understand what the practical, social and economic implications will be for them and their families, as well as the country as a whole.

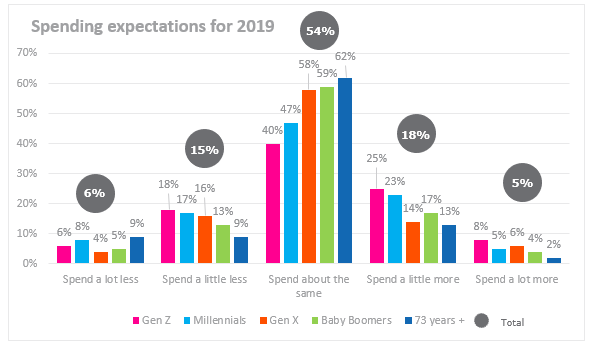

At the end of 2018/early 2019 DJS Research conducted a retail survey (with 1,000 Nat Rep UK respondents) and found rather mixed consumer confidence for the year ahead. While more than half of UK consumers state they are planning to spend about the same in 2019 compared to the previous year (54%), a little over a fifth expect to spend more (21%), while a further fifth anticipates spending less (23%).

Those who anticipate spending less in 2019 state a range of reasons. Just over a quarter (26%) are driven by their personal situations, e.g. having less disposable income, while slightly less than a fifth (19%) said budgeting or trying to avoid debt. Others (12%) reference macro factors such as the impact/uncertainty of Brexit on their financial situation, or inflation impacting on the general cost of living (10%). Interestingly, these same reasons are stated by those who anticipate spending more in 2019. Inflation and the increased cost of living accounting for almost half (45%) of responses amongst those who expect spending to increase in 2019.

The current economic uncertainty by its nature means consumers are divided about how they will respond; cut back and try to build a financial reserve to see them through the period of uncertainty or resign themselves to an anticipated higher cost of living and therefore expenditure.

.jpg) This exacerbation of rising costs seems to have the loudest voice when we look at which sectors consumers expect to spend the same or more in 2019 vs. 2018. It is the everyday essentials such as groceries (90%), personal care (89%) and clothing, footwear & accessories (84%) where most consumers expect to spend the same or more in 2019 vs. 2018. Consumers anticipate these purchases being impacted by inflationary pressures resulting in higher costs over the year.

This exacerbation of rising costs seems to have the loudest voice when we look at which sectors consumers expect to spend the same or more in 2019 vs. 2018. It is the everyday essentials such as groceries (90%), personal care (89%) and clothing, footwear & accessories (84%) where most consumers expect to spend the same or more in 2019 vs. 2018. Consumers anticipate these purchases being impacted by inflationary pressures resulting in higher costs over the year.

However, conversely, consumers anticipate spending the same or less across many non-essential categories. Over nine in ten (91%) said they expect to spend less on flowers, greeting cards and gift, jewellery & watches (89%), music, movies & videos (88%), books & magazines (88%) video games, consoles & accessories (86%) and gardening equipment & consumables (84%). In these non-essential categories, consumers seem to feel they have more flexibility to cut back their spending and make some savings compared to their everyday essentials. So, what does this mean for retailers?

After a turbulent year for many UK retailers in 2018, consumer uncertainty around the financial outlook ahead of Brexit, and anticipation of same or lower spending across multiple categories suggests 2019 is also likely to be a challenging year for the retail sector.

Is there any room for retailer optimism for the year ahead?

The familiar sound of the ‘high street is dead’ precedes most Brexit discussions, but in fact, this truism is being challenged by both retailer and consumers.

Experiential-retail is the new buzz word on the high street and the retailers who are focused on creating experience-led retail spaces seem to be defying the naysayers. Digital technology advancements in store, alongside great customer experience, and of course, seamless omnichannel delivery, puts the consumer in the driving seat, and for Gen Z and Millennials particularly, this is a must to securing their share of wallet … or rather a share of their Apple Pay!

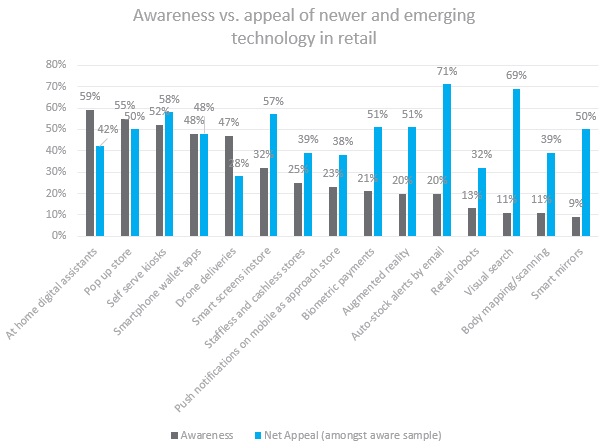

Interestingly, some of the most appealing tech developments in retail are least well known amongst consumers currently; only a fifth (20%) are aware of auto-stock email updates, but almost three quarters (71%) say this is appealing, and while only one in ten (11%) has heard of visual search previously, a whopping seven in 10 (69%) like the sound of it! There is clearly untapped potential for retailers to capitalise on adopting technologic advancements which enhance the customer experience.

However, as technology becomes more established it seems appeal can start to wane; appeal for 'at home personal assistants' (42%) and 'pop-up stores' (50%) is actually lower than awareness for these initiatives (59% and 55% awareness respectively).

Gen Z and Millennial Customers

Retail never stands still, and the integration of technology into the customer experience is clearly no exception. For retailers with a Gen Z or Millennial target customer, the expectations are higher still …

.png)

.png)

So, while there is no doubt consumer confidence is somewhat wobbly as we move through the first quarter of 2019, the question is: "will retailers be able to do enough to entice nervous UK consumers to spend?". Only time will tell, but those who understand and embrace their customers’ needs and adapt to a more experiential customer journey will inevitably be in the best position to succeed.

To find out more, or to conduct your own research within the retail sector get in touch with one of our retail specialists: Gill Redfern, Rebecca Harris or Sharon Nichols.